|

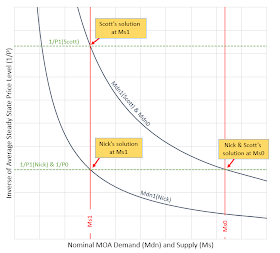

| Figure 1: Nick Rowe's and Scott Sumner's solutions for P |

This is a simple hypothetical that I feel get's to the core of concepts like the long term neutrality of money, the quantity theory of money (QTM), and the hot potato effect (HPE) which undergird much of Market Monetarist (MM) thought. If I'm not mistaken, Nick Rowe seems to think my hypothetical is a case where those concepts don't work, while Scott disagrees. Why do I care? Well if they don't work here, then what about our real situation does make them work? How can we be certain that they are indeed working, and if they are how do we know they are completely working?

Setup: This is basically the same as Scott Sumner's "cashless society" hypothetical (case 7) except with the added stipulation that there's just one commercial bank and that the reserve requirement is 0% (Scott didn't specify the number of commercial banks or the reserve requirement). In particular, we have:

- Cashless society (no paper reserve notes and no coins).

- A central bank (CB) which can buy and sell assets (open market operations (OMOs)).

- A single commercial bank with a CB deposit (i.e. reserve deposit). This is the only existing CB deposit account.

- The reserve requirement is 0%.

- A non-bank private sector which holds deposits at the commercial bank.

P = average steady state price level in the private economyScott Sumner and Mark A. Sadowski say that if Ms changes (e.g. through CB OMOs), then P will change in proportion. Nick Rowe says that in this case demand for reserves will change with Ms. Specifically he noted that if Ms goes to zero then demand for reserves will go to zero. If we take this to mean that demand is proportional to Ms, then P stays fixed regardless of the change in Ms.

Ms = reserve supply

Mdn = nominal reserve demand

Mdr = real reserve demand = Mdn/P

The difference between Nick's and Scott's solution is illustrated in Figure 1 for two different values of Ms: we're assuming they start off the same at Ms = Ms0, but then the CB sells assets such that Ms = Ms1. The demand curve (Mdn) in Nick's case scales in proportion to Ms (this is accomplished by scaling Mdr). Nick Rowe says that my Figure 1 looks roughly right. Click here to see an animation.

My question for Nick is what is preventing the long term neutrality of money in this case? What would I need to change about my example, aside from adding cash, for him to agree with Scott? For example, would adding multiple commercial banks do it? Something else? What's the minimum change required?

Relating my hypothetical back to reality, is it really so outlandish to consider the case of a single commercial bank? Mark Sadowski identified a case in France in which the banks were nationalized, and he notes with little effect. In terms of a cashless society, Mark is convinced we'll still have cash a hundred years from now, but Scott agrees it is going away at some point. I believe Canada looked into the consequences of going cashless. But even if Mark is right and cash is here for the long haul, does it really make much of a difference? Isn't it just an arbitrary choice by the depositor about which form to keep his money in? (Mark & Mishkin agree it's the "depositor's choice.") Does it really affect the long term neutrality of money, the QTM and the HPE?

*Although only reserves are MOA, I think both Scott & Nick would agree that both reserves and commercial bank deposits are a medium of exchange (MOE) in this case.

For those wishing to see the above change in Ms sketched out in balance sheets, look here.

Tom, I don't have much to contribute -- I'm having problems following the various threads of the argument. Perhaps if you gave more background, like why you're interested in this chart and these questions, it would help. But in any case, I applaud your efforts to weave various blogs and bloggers together in your effort to learn. I like to do that too.

ReplyDeleteHi JP, thanks for taking a look! I did put put (in tiny print) the reason I'm interested:

DeleteWhy do I care about this problem? This extremely simply hypothetical gets to the core of what circumstances the long term neutrality of money applies to. If this theory falls apart with a single commercial bank (Mark A. Sadowski says banks in France were nationalized with little effect) or no cash then what keeps it working under normal circumstances?

I'm curious about this scaling of demand that takes place. Rowe gave a very similar answer to a case where he described a transfer of demand. In that case neither Sadowski or Sumner objected. That was a case where the CB took over the banks. Rowe essentially said the demand for the banks' bank deposits would transfer to the new CB customer deposits, thus multiplying demand for base money at the same time supply of base money went up, thus leaving prices unchanged. Neither Sadowski or Sumner came up with that answer, but one Nick had, they didn't object.

Again, this to me gets at the core of the hot potato effect and the long term neutrality of money and the QTM: Nobody told us that DEMAND for the MOA might change... but apparently there are circumstances in which demand for MOA changes along with supply thus undoing the effects of changing the supply. How do we know that isn't happening at least to some extent with QE in our present circumstances?

I've changed it now to lead off with why I'm interested in this problem.

DeleteTom, this doesn't make a great deal of sense to me.

ReplyDeleteFirstly, if there is only one commercial bank, why are reserves needed at all? Payments would simply be balance sheet transfers on the liability side of the bank's balance sheet, which would have no effect on reserves (since they are assets). It's a completely closed system.

Given that reserves remain unaffected by payments in this system, Mdn and Mdr would both be zero. (That doesn't mean Ms would necessarily be zero though - see next paragraph.) New loans would increase broad money but base money would not rise in response. I can't for the life of me see how the supply of reserves would in any way relate to the price level in the private economy. What would determine it would be the supply of broad money. Therefore the putative relationship that this model shows between reserve supply and private sector price level is entirely spurious.

In this model, reserves on a bank balance sheet are electronic cash. If the central bank sold sufficient assets to reduce the reserve supply to zero, therefore, the single commercial bank's electronic cash holdings would also reduce to zero. This would apply whether the bank itself bought the assets or the non-bank sector did. If the latter, then the commercial bank would be left with a much riskier balance sheet. That might reduce its willingness to lend, I guess. Or it might not - after all, it still has equity and it makes money out of taking risk.

More seriously, though, if there are no cash assets on a bank's balance sheet, how on earth does it pay its staff or purchase fixed assets? Or any sort of asset, actually - including safe assets to replace the lost cash assets? You really don't want a central bank reducing its cash liabilities to zero unless you plan to eliminate the entire banking sector.

I guess I've trashed the whole model, haven't I?

If you adjust the model so that there is only one bank, which creates all money (whether through OMOs or lending, or both, doesn't really matter), then we have a simple supply-demand function: borrowers demand loans, bank supplies them (creating money) and the quantity of money is determined by its price. As this is a central bank, we assume that all its lending is guaranteed by the state, so the risk of lending cannot be used to determine the price. All loans would have the same interest rate. How would that interest rate be determined?

Indeed, where is the interest rate in this model anyway?

Frances, first of all thank you for your thoughtful reply. Keep in mind a couple of things though:

Delete1. The point of this post was to build off the internal logic of Scott's "Hot Potato Effect Explained" ... and in particular his "cashless society" case 7. The purpose was not to model reality: it was to take the logic of Scott's post and see where it leads. Scott claims the HPE works just fine in that case.

2. How can the bank buy anything or pay it's employees? Same as it pays for anything: it credits their deposits. In a very general sense the aggregated banking system makes payments to entities in the non-bank private sector by crediting their deposits. Those entities may wish to later withdraw those deposits as cash. Likewise banks accept payments by debiting deposits. In a similar fashion the central bank makes payments by crediting deposits and accepts payments by debiting deposits.

3. Why would the bank have any demand for reserves? I don't know: let's ask Scott Sumner: it's his model I'm borrowing! :D ... but actually I do have an idea: should the CB want to purchase something it has to use the bank as an intermediary, and thus the bank needs those reserves to offset the credits the bank gives the assets sellers' bank deposits: i.e. w/o the reserves the bank would lose equity when the CB bought something.

... also, regarding interest rates: well again I'm trying the use MM logic and see where it leads. They hate talking about interest rates and point out all the time that pre-2008 the Fed (for example) may have targeted interest rates, but it did so by adjusting the quantity of base money: the implication being that quantity of base money is the fundamental thing of importance and interest rates are more of a byproduct. Well in the Sumner/Brown hypothetical I use here, we skip the interest rates as an unnecessary intermediate variable and go straight for adjusting base money.

Delete... and yes, I purposely used Scott's hypothetical here, adding in the bits about a single commercial bank, etc. to make the reserves as useless as possible. Scott still claims HPE works and it only works on reserves in this case, so I accept that logic and see where it takes me: apparently Nick wasn't prepared to follow Scott there, and I'm wondering why not. What would it take to get Nick back on board with HPE... what changes do I need to make for Nick to confirm that HPE is functioning again?

... I guess I was asking you (and JP above) to take a guess as to why Nick jumped ship on HPE in this case. Assuming that HPE can indeed still work w/o cash, is the answer because there's just one commercial bank? Does the presence of multiple commercial banks (thus necessitating the movement of reserves to clear payments) give them value? (i.e. translated into Nick speak, does this mean that the demand for reserves stops being proportional to the quantity?... thus re-animating HPE for Nick?)

DeleteTom,

DeleteHPE could work perfectly well without physical cash. Indeed most payment models don't take much notice of physical cash - physical cash transactions are a tiny proportion of the transactions in the financial system. Physical cash movements into and out of banks do cause the level of reserves to change, but the effect is generally insignificant. Only in a crisis do physical cash movements really become important.

So I would guess that Nick's problem is the same as mine - it's not the cashless society that's the problem, it's the single bank model. HPE doesn't work AT ALL if there is only one commercial bank. You need multiple banks in order to create demand for reserves: it is the movement of reserves from bank to bank as payments are made that create the demand, because banks must balance their reserve accounts. If all payments occur within the same bank, there are no reserve movements and there is therefore no demand for reserves.

However, HPE would work in a genuinely single-bank model. The movement of money across non-bank deposit accounts at the single (central) bank would create the HPE. In fact monetarists (of any kind) seem to be instinctively happier with a single-bank model, because then all money is base money and MV=PQ works much better.

I do wish American market monetarists would look outside their own borders. The Fed adjusts the Fed Funds rate by means of open market operations. But both the Bank of England and the ECB explicitly set the interest rate as the rate at which they will lend reserves to banks against good collateral. OMOs are used to keep market rates on other instruments broadly in line with the base lending rate.

On bank payments to employees - yes, it credits employee deposit accounts on its own balance sheet, but what would be the associated asset? Or are you suggesting that in the absence of base money (which is what zero reserves would mean), the commercial bank wouldn't have to balance its balance sheet?

Frances, thanks again for another thoughtful answer. That was precisely what I was looking for. Now if I could get Nick to take another look and either confirm or deny that... :D

DeleteBTW, I do draw balance sheets for the above here:

http://banking-discussion.blogspot.com/p/nick-vs-scott-hpe-hypothetical-balance.html

You write:

"On bank payments to employees - yes, it credits employee deposit accounts on its own balance sheet, but what would be the associated asset? Or are you suggesting that in the absence of base money (which is what zero reserves would mean), the commercial bank wouldn't have to balance its balance sheet?"

Hmmm, I'm not sure what you mean about assets. When the bank (assume a single bank like in the above, or the aggregated banking sector) makes a payment, it' directly affects it's equity. That's how I'm thinking of it: They pay their electric bill $100 and their equity goes down $100. Their borrowers pay them $50 in interest payments, and their equity goes up by $50. I do a post on it here (showing simplified balance sheets):

http://brown-blog-5.blogspot.com/2013/03/banking-example-5-bank-spends-excess.html

Also, although I do understand your answer, I don't think that leaves bank reserves completely valueless. For example, if the CB puts assets up for sale, then the bank can purchase those from it's CB deposit account. Also it gives the bank a way to act as intermediary between the non-bank public and the CB for OMOs. But I am inclined to agree with Nick that the demand for reserves scales with their quantity in that case. If it doesn't scale at ALL then you have Scott's answer. That's nothing new from Scott (it's his case 7) but he confirmed to me recently that it should also work for a single commercial bank. This doesn't surprise me from Scott: he's being consistent: he's always said he's not interested in banks or the "credit" they produce. My question here was really designed to drive a wedge between Scott's world view and Nick's and in that regard it worked I think! Not that I want to cause trouble... it's that I want to understand why Nick thinks this is a special case. It may very well be because of the single bank issue like you point out. So Scott's answer doesn't surprise me. It seems counter-intuitive, but not surprising coming from him. Nick's answer is really the interesting thing to me.

Delete"Also it gives the bank a way to act as intermediary between the non-bank public and the CB for OMOs. " ... that's what I show on the balance sheets I link to above.

DeleteBut in this model the CB is actually redundant, I think. The private sector does not use base money (because there is no physical cash), and the commercial bank creates all the credit money the private sector needs and settles all its own transactions. I accept your point that absence of cash assets doesn't prevent the commercial bank making purchases, but the implication of this is that the commercial bank has no need whatsoever for the central bank and neither does anyone else. So you would have the interesting spectacle of a central bank with effectively no money creation powers trying to control the creation of money by the (far more powerful) commercial bank by means of wholly unnecessary OMOs. Why on earth would the commercial bank bother with this, when it could do OMOs of its own in competition with the CB? Or, if it really did want to purchase CB assets, it could simply purchase them in the same way that it would from the market - i.e. by means of its own credit creation function. I still can't see any use at all for reserves in this model. In fact I can't really see any use for the central bank.

DeleteThe only value of the central bank to the commercial bank would be the central bank's lender of last resort function, which in effect guarantees the money created by the commercial bank, thus ensuring that the private sector will always want to hold that money. But this makes the central bank an insurance company, not a bank. And the guarantee is a government guarantee anyway: FDIC-insured deposit accounts are contingent liabilities of the federal government. In this model, therefore, why have a central bank at all? Why not simply recognise that liabilities of the commercial bank are guaranteed by government?

Frances, thanks again for stopping by. All the points you bring up are excellent, but again, that was my purpose: I wanted to see how far Scott and Nick would stick to Scott's model. Scott was totally consistent with everything he's always said and stuck with it all the way, affirming that the HPE would work just like he laid out in his Case 7, even with my added stipulations. And Mark Sadowski agreed with him. So that's interesting in itself. However, the truly interesting thing is why Nick Rowe jumped ship? What was the straw that broke the camels back with Nick... that's what I'd like to know. :D

DeleteThe value of private bank money is normally defined by convertibility into central bank money. But in this scenario, nobody can hold CB money except for the one bank. So what ties together the value of CB money and bank money? It seems like the private bank would have the power to define the value of its money, and the CB would be impotent.

ReplyDeleteHi Max, thanks for commenting.

DeleteYou may be correct, but again I'm going off of Sumner's example. I think you can do a conversion in a sense. Check out the balance sheets I provide on the link at the bottom of the post: The CB is still free to purchase assets, and in that case the bank will do the converting taking in CB dollars on one side and issuing bank liabilities on the other. Likewise, the CB can purchase dollar denominated assets using reserves and then sell them to the public, accepting payment from the public by debiting deposits by that same dollar amount (plus a bit of profit perhaps). Now what's to prevent the bank from "gouging" on prices? Well it has a monopoly, so only regulation would do the trick I guess. I could add "the commercial bank is a regulated monopoly" to the list of assumptions.

Keep in mind my idea here is to push the HPE as far as it can go. Summer didn't specify a reserve requirement or the number of commercial banks. He always says things like banking should be of no more concern to macroeconomists than any other industry, and that banks and the "credit" they produce is not a macroeconomic concern. So I wanted to explicitly see if he was still OK with the HPE with my added stipulations here... and he was! He is being very consistent. But somewhere along the line Nick Rowe jumped ship. I want to know why exactly, in terms of Nick's thoughts.

DeleteIf regulation is effective, the difference between a regulated monopoly and a nationalized industry is vanishingly small. And the commercial bank in this model would have to be backstopped by the government anyway, precisely because it is a monopoly. Just think what would happen if it failed....

DeleteThere would have to be a reserve requirement for the commercial bank to bother to hold reserves at all. It has no reason to do so.

I still think Nick jumped ship because this model just doesn't work. He's now gone for a genuinely one-bank model, rather than having this artificial one-on-one "redundant-central-bank" & "not-really-a-commercial-bank-but-pretending-to-be" duopoly. Scott may be consistent, but he's ignoring commercial reality.

"Likewise, the CB can purchase dollar denominated assets using reserves and then sell them to the public..."

DeleteDo you mean, the CB can purchase assets from the monopoly bank at a price dictated by the CB? That's quite different than how a normal CB works, because it's not an "open market" transaction.

Max, you can assume there's primary dealers still. They act as an intermediary, get a check from the Fed which they deposit in the bank. The bank thus gets reserves and the PD get's a deposit. I don't know the details but I assume it works something like that.

DeleteAs this is Nick not Scott, I wouldn't make any such assumption. Canada has universal banks, not primary dealers - or, if you like, the banks ARE the primary dealers, as they are in the UK. If Nick says one bank he means one bank, not "one bank plus several other things that aren't banks but look like them".

DeleteFrances, OK sure... I'm just thinking how a CB purchase of assets would be accomplished. I usually ignore the PDs myself... I just like to imagine the banks acting as an intermediary directly, which is what it sounds like you're describing. In this case, suppose the bank, as part of it's charter, had to act as an intermediary for CB OMOs, and was allowed (by law) to take a certain maximum % as a fee, say 1%. It would probably still be to the bank's advantage to do so since they could build equity with each transaction and thus afford to pay their shareholders bigger dividend checks.

DeleteBut I don't want to spend too much time defending this world. This is Scott's world. I nailed down the number of banks at 1 and the RR at 0%. He didn't raise a hand and object. That makes reserves about as useless as I can imagine. That's kind of my point. :D

Frances & Max,

ReplyDeleteIt occurs to me another name for this post could be:

"Where does Nick disembark the HPE Express?"

Or from another point of view:

"Exactly where does Nick jump off Scott's crazy train?"

:D

I find Tom's setup truly important, it strikes to the heart of the monetarism. I do not think it is fair to dismiss hypothetical as a model should work also in the extremes or one should be able to say which assumption breaks the model and why. This greatly illuminates things.

ReplyDeleteI really would like to see what Nick comes up with as for me his model seems to be the closest/most sensible one.

I think your (Tom, Coppola) arguments about HPE, nationalizing/single bank and demand of reserves is (one of) the key(s). I think a plausible model should work similarly with one or many banks. It just doesn't make sense that the economy would work totally different just by changing the amount of banks (supported by France example).

I think that is why I prefer Cullen's emphasis of loan creation, capital and commercial bank side. But then again Cullen, in my view, do not have a fully specified model for inflation.

Jussi, thanks for commenting. I'm glad *somebody* appreciates my annoying hypotheticals. :D

Delete